Get a Loan in Zambia in Just 1 Hour with ZamLoan: Your Fast Financial Lifeline

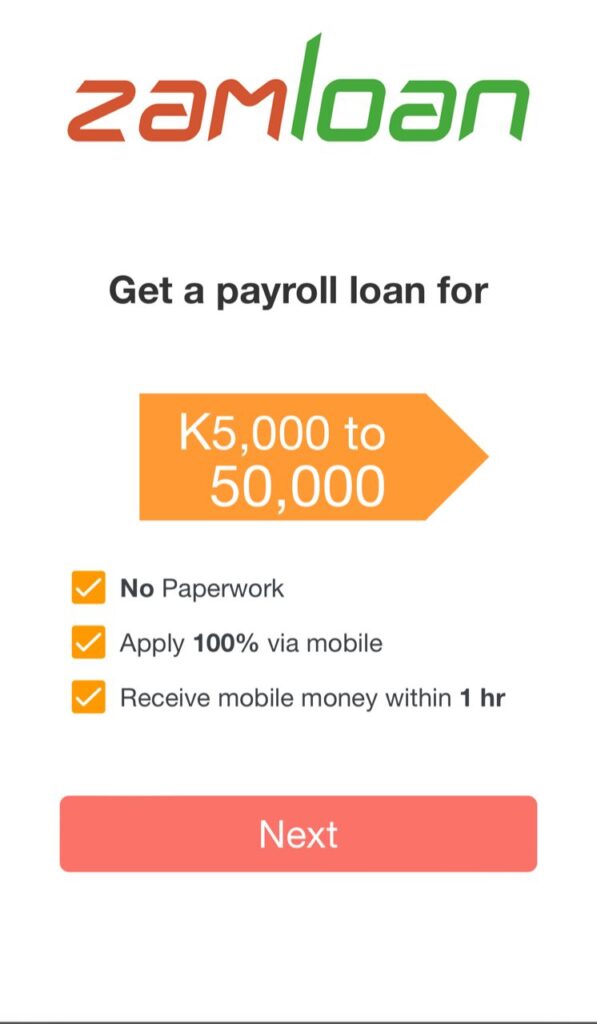

Life in Zambia can be unpredictable. Unexpected expenses can arise anytime, leaving you in a tight spot. Thankfully, with ZamLoan, you don’t have to wait days or weeks for a loan approval. Their innovative platform allows you to get a loan in Zambia in just 1 hour, entirely through your mobile phone.

This blog post dives into the benefits of using ZamLoan and how it simplifies the loan application process. We’ll also explore some key takeaways to consider before applying for a loan.

The Power of Convenience: Why Choose ZamLoan?

- Ditch the Paperwork: Unlike traditional loan applications burdened by mountains of documents, ZamLoan offers a completely paperless process. Say goodbye to tedious paperwork and hello to a streamlined online experience.

- 100% Mobile Application: Gone are the days of visiting banks and waiting in lines. ZamLoan allows you to apply for a loan anytime, anywhere from the comfort of your mobile phone. Their user-friendly app makes the process quick and effortless.

- Lightning-Fast Approval and Disbursement: Experience the speed of ZamLoan’s service. Get approval within 1 hour and receive your approved loan amount directly deposited into your mobile money account within 60 minutes.

Applying for a Loan with ZamLoan: Simple Steps, Big Impact

- Visit the ZamLoan Login Page: You can find the login page on their website (details likely available on their website).

- Register for an Account: Create an account by providing your basic information.

- Choose Your Loan: Select the desired loan amount and repayment term that best suits your needs.

- Complete the Online Application: Fill out the short and user-friendly online application form.

- Submit and Await Approval: Once submitted, ZamLoan will review your application and notify you of the decision within 1 hour.

Get a Loan in Zambia in Just 1 Hour with ZamLoan

Before You Apply: Key Considerations

- Interest Rates and Fees: It’s crucial to understand the interest rates and any associated fees before applying. Make sure you can comfortably afford the monthly repayments.

- Eligibility Criteria: Ensure you meet ZamLoan’s eligibility requirements, such as age, income level, and residency status. These details are likely available on their website. Get a Loan in Zambia in Just 1 Hour with ZamLoan

- Borrowing Responsibly: Only borrow what you absolutely need and can realistically repay within the stipulated timeframe. Responsible borrowing is key to maintaining good financial health.

Get a Loan in Zambia in Just 1 Hour with Confidence

ZamLoan offers a fast, convenient, and paperless solution for your short-term financial needs in Zambia. Remember, responsible borrowing is key. By carefully considering the interest rates, fees, and your repayment ability, ZamLoan can be a valuable tool to navigate unexpected financial situations.

Experience the Efficiency of Mobile Loans with ZamLoan Today!